PSD2 Open Banking

Create an interconnected experience for your customer, where all financial entities come together. Enable your customer to do more, and make your business grow.

Main features

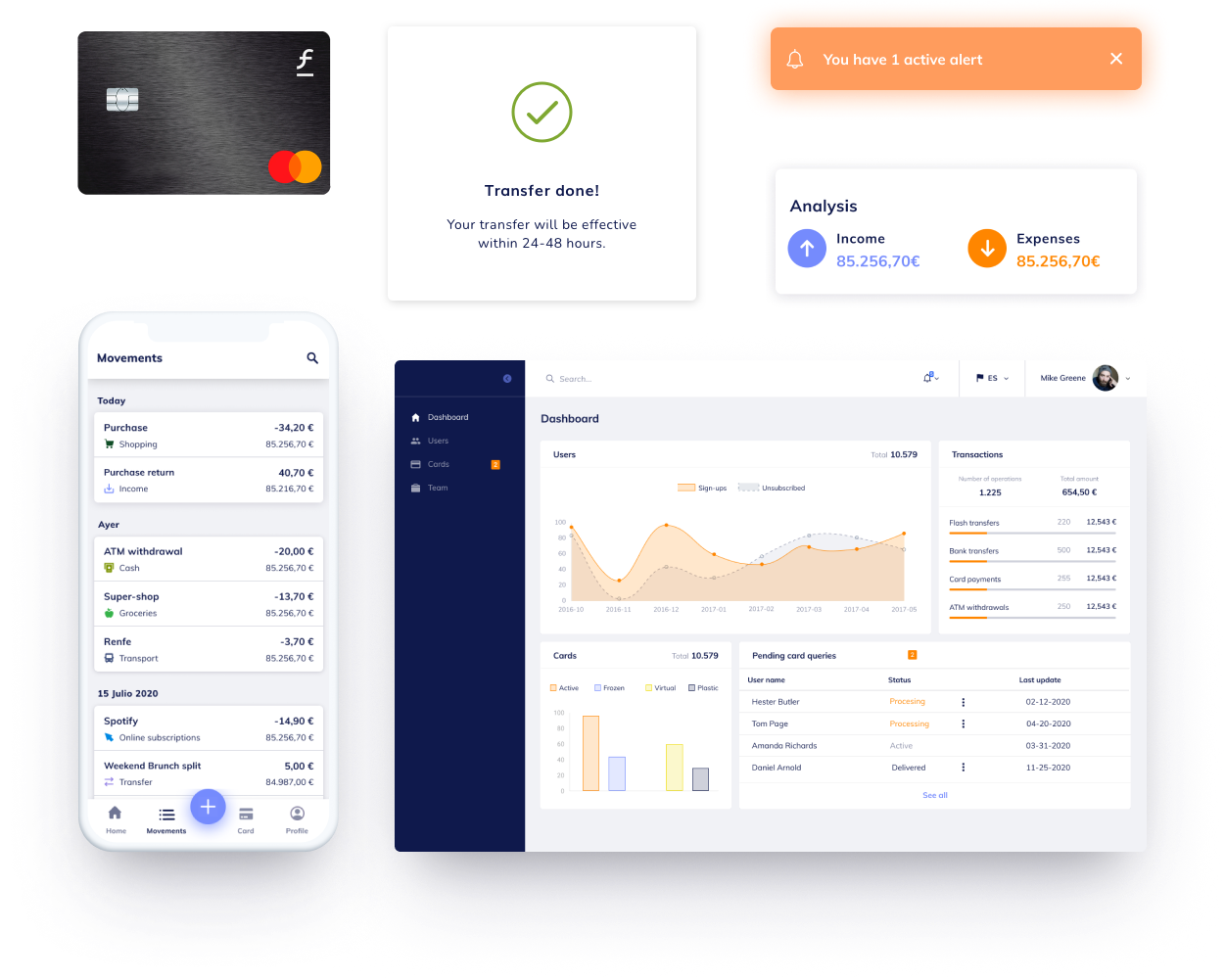

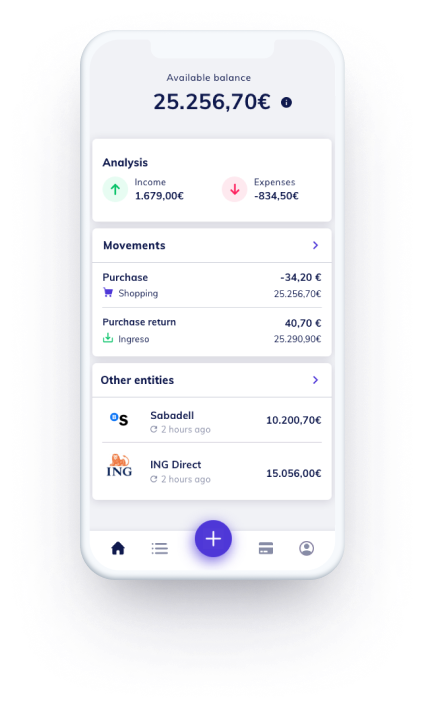

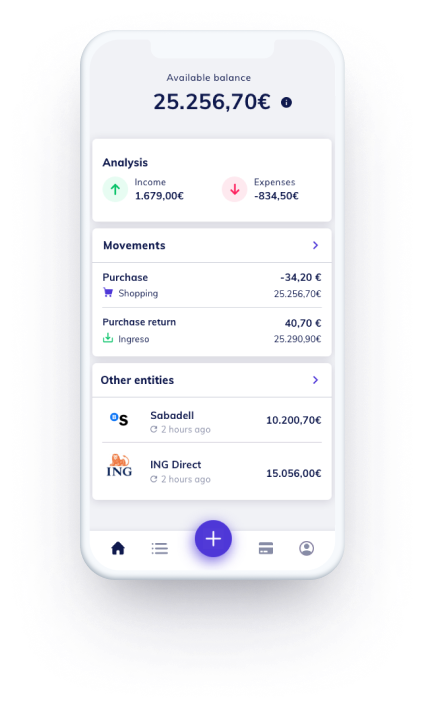

PSD2 aggregation

Connect to all financial entities of your customer to assess the full picture

Risk scoring

Assess risk at every financial operation of your customer

Personalized insights

Deliver relevant information for your customers to make better decisions

Payment initiation

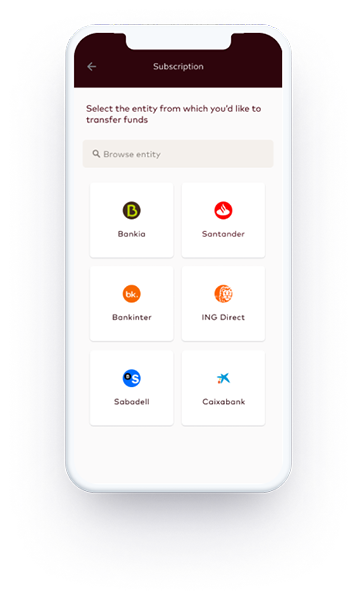

Enable payments initiated securely from your customers' entities

PSD2 aggregation

Connect to all financial entities of your customer to assess the full picture

Risk scoring

Assess risk at every financial operation of your customer

Personalized insights

Deliver relevant information for your customers to make better decisions

Payment initiation

Enable payments initiated securely from your customers' entities

An advantage for your business

Minimize friction

Your customers access all their financial network just from one place, minimizing transitions between platforms and cleaning the user experience

Increase conversion rates

Integrate payments, transfers and withdrawals in your platform, simplifying the experience, and increasing operations volumes

Enhance risk assessment

Collect all necessary data in minutes for a comprehensive assessment right from your platform

PSD2 Open Banking in action

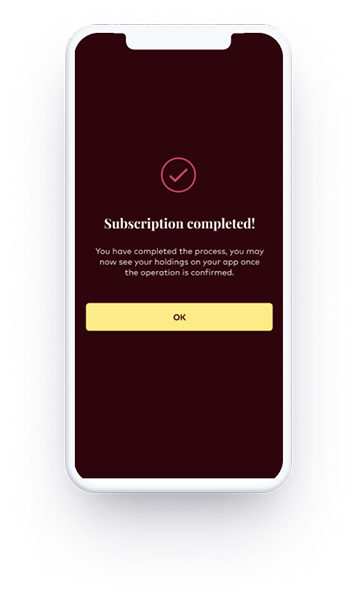

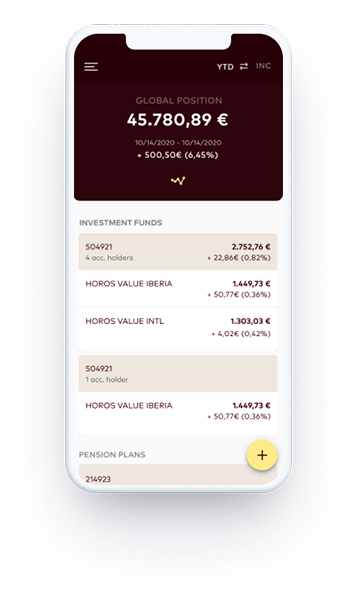

Horos, a wealth management firm, partnered with b·neo to connect customers to their entire financial network, to obtain full visibility of their positions and make better decisions on the platform.

Aggregation of all financial entities of customers

Secure money transfers initiated from customer entities

Check out other b·neo products

The digital tool your investors are demanding

Create your own baking environment with cards and ES IBAN

3 ways to integrate into your business

New standalone app

Refresh your digital presence with a brand-new application to delight customers and attract new ones

1

New standalone app

Refresh your digital presence with a brand-new application to delight customers and attract new ones

App-in-app

Leverage a quick uptacke and acquisition to new services by embedding b·neo into your current app

2

App-in-app

Leverage a quick uptacke and acquisition to new services by embedding b·neo into your current app

New functionality

Deliver new functionalities totally integrated into your current stack

3

New functionality

Deliver new functionalities totally integrated into your current stack

6 reasons why

Modular architecture

We offer an architecture made up of modules to cover all your needs at your own pace.

The best fintech portfolio

We connect you to the best, always-updated, tech portfolio on the market.

PSD2, MiFid2 Compliance

Our solutions are regulatory compliant so you can operate worry-free.

Full integrability

We integrate b·neo into your own tech stack, without overburning your internal capacity.

EU and LATAM scale

Functional solutions in Europe and LATAM for you to reach new markets rapidly.

Industry experts

Count on expert developers, architects, and designers during our partnership.